Verve’s GoodLife Promo Returns with Bigger Rewards.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

Verve eCash is a virtual card and wallet that lives inside the Quickteller app, which is perfect for secure online transactions without the need for a physical card. When you sign up, your virtual card details are stored securely in your wallet, and tokenization kicks in every time you make a purchase.

Shopping can be a thrilling experience, especially when discovering unique items on Temu. One common obstacle shoppers face is payment issues, particularly when using cards that may not be compatible. However, if you have a Verve card, you're in luck,because it's fully operational on Temu, allowing you enjoy a seamless shopping experience.

Time is money, and nobody likes to waste it, especially when making payments. Long queues and slow processing can be frustrating. Verve, Africa’s renowned payment card, now offers a contactless card that addresses these concerns. By simply tapping your card, you can save more time per transaction, providing a streamlined solution for all your payment needs.

Africa’s 1st and largest domestic payments scheme and a subsidiary of The Interswitch Group, has been named in the first-ever Global Payments Power 50 list by The Power 50, recognising the most innovative companies driving innovation and transformation in the global payments industry.

Have you ever wanted to master a new skill, switch careers, or finally take that course you've been considering? Now is your chance. With Verve Card now accepted on Udemy, learning has never been easier. Whether you're a professional looking to advance in your field, a student eager to expand your knowledge, or simply curious about exploring a new passion, you can access thousands of courses seamlessly.

Was your financial situation in shambles last year? Let’s face it, juggling subscriptions, online shopping, and everyday expenses without a plan can feel like a big task. Well, say goodbye to the old you, and let’s get you ready to meet the "new you" by making the most of your Verve card this year.

Proper fueling your body before and after a workout is just as important as the exercises themselves. Whether lifting weights, running, or dancing, what you eat can make or break your performance. The right fuel gives you the energy to power through tough workouts and helps your muscles recover faster afterward.

“Water no get enemy.” This famous Nigerian proverb holds more truth than you might realize. As simple and literal as it sounds, water is indeed a lifesaver. Whether you’re powering through a fitness routine, attending a high-energy workout session, or just going about your day, staying hydrated is a must.

We all want to move through life with ease; from bending, lifting, and reaching without a second thought. But let’s face it, everyday movements like picking up groceries, getting out of bed, or even playing with the kids can become challenging if your body isn’t in shape. That's where the magic of exercise comes in.

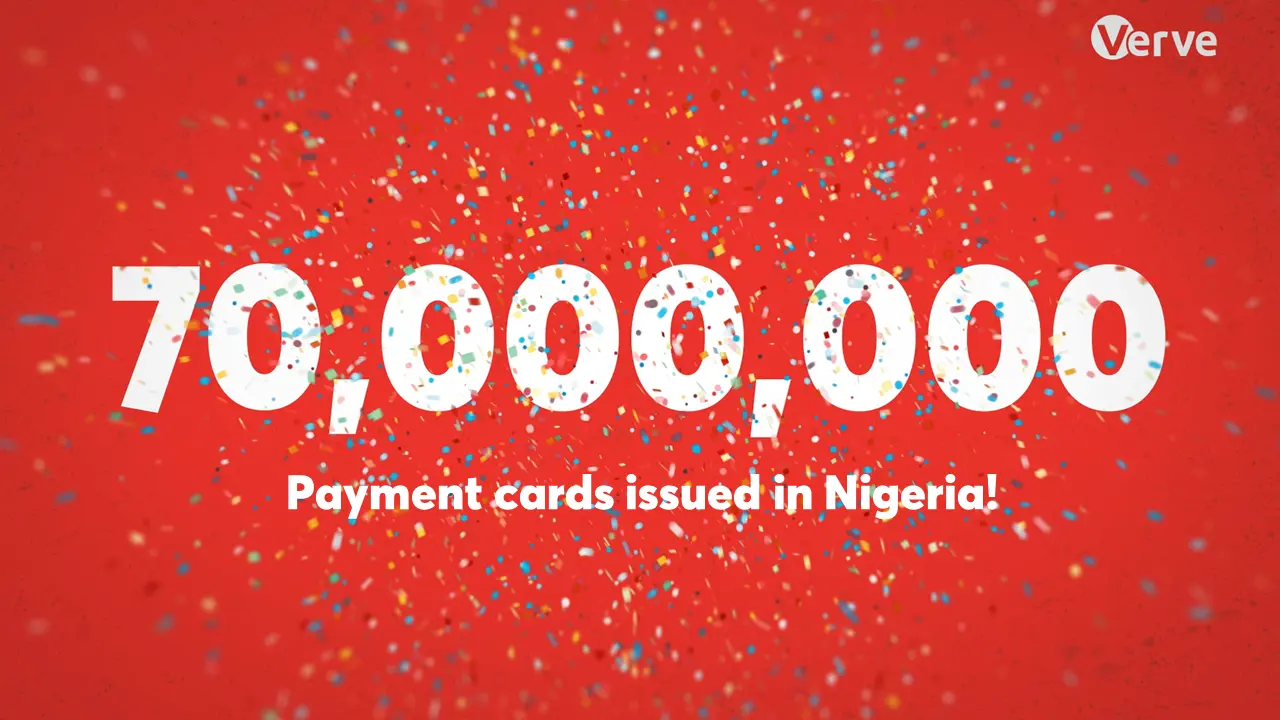

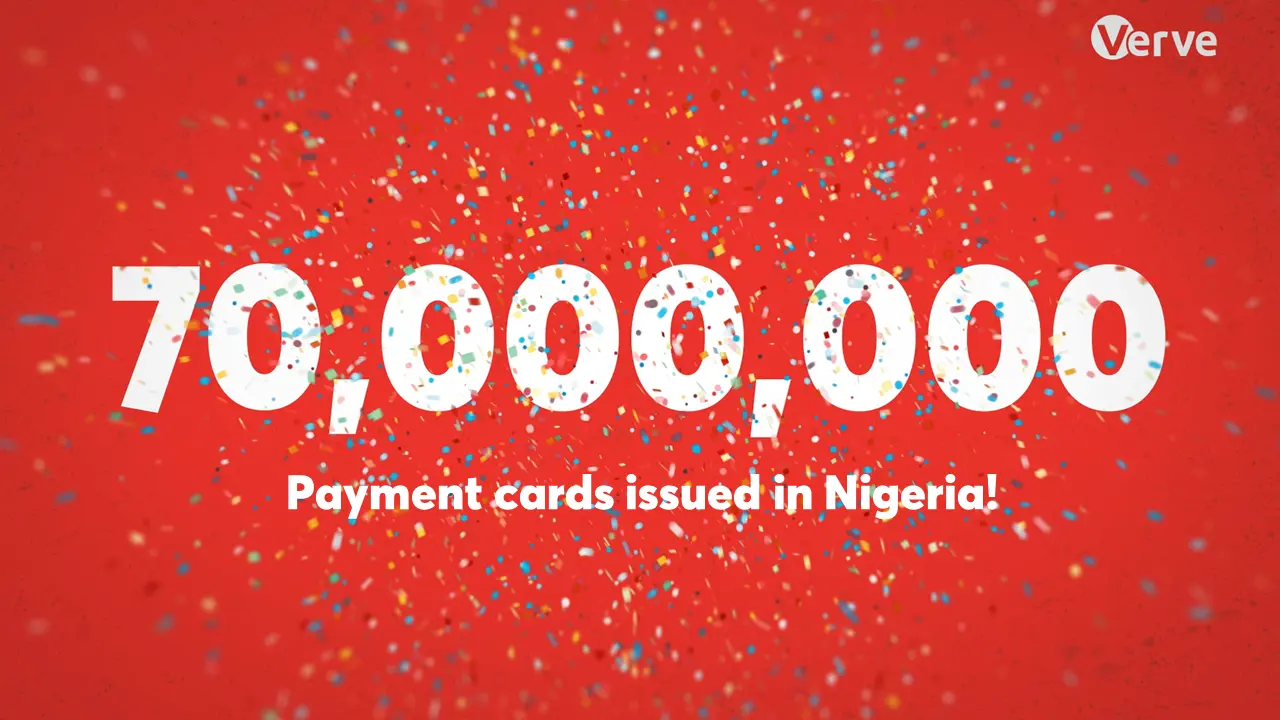

Verve International, Africa’s 1st and largest domestic payments scheme, and an emerging reference-point in the burgeoning realm of domestic payment schemes globally, has again announced another remarkable new growth milestone, further consolidating its growing market share in Nigeria, in terms of payment card issuance and transactions.

Recently, we hosted a event for our ecosystem partners. The day was filled with games, networking, and sharing important milestones. It was both exciting and educational.

Have you ever felt like you just wanted to pause, close your eyes, take a deep breath, and escape from the chaos of everyday life? We all do. The stress, noise, and constant demands can sometimes feel overwhelming. But what if you didn’t need a vacation to find peace? What if just a few minutes of moving your body could calm your mind and boost your mood?

We are pleased to announce that XHSmart has joined our network. XHSmart is a new personalization bureau that has been onboarded to support Verve issuers in Uganda. With their impressive background and technical skills, XHSmart brings a wealth of knowledge and expertise to our dynamic network. As Verve continues to grow and innovate in the financial technology sector, we believe that XHSmart's addition will undoubtedly contribute to our success, and we look forward to achieving new milestones together with delivering exceptional solutions to our clients. XHSmart is poised to contribute significantly to our ongoing and future initiatives, including our African expansion plans.

Verve is in a class of its own when it comes to making sure that cardholders live and enjoy the good life! Typical of Naija's "Agba" and "Odogwu" card to keep adding steez to its customers, it has added another goodie to its bouquet of good life. I guess you’re already wondering what this is about. Well, Verve has just added another feather to its already heavily decorated cap just for your uninterrupted pleasure.

Imagine walking into your favourite store, picking up everything you need, and getting an instant discount just for being a loyal customer! Okay, hold that thought but stop stalling.

Nigerians are known for their loyalty to brands that demonstrate resilience, make impactful contributions, and consistently offer solutions to their challenges. This is why millions of people in, and outside Nigeria are increasingly choosing Verve Card for its unmatched convenience and seamless transactions.

Africa’s leading payment cards and digital tokens brand, Verve, has partnered with uLesson, an online learning platform to offer 10% discount off educational content and gadgets when payments are made with Verve cards on the uLesson website (ulesson.com).

Verve Card is a type of debit or prepaid card that allows you to make payments, withdraw cash, and shop online or in physical stores. Read more.

Africa’s leading payment cards and digital tokens brand, Verve, has announced its partnership with the Lagos State Government on the relaunch of the Lagos State Residents Registration Agency (LASRRA) card.

The convenience of making purchases online comes with the responsibility of protecting one's sensitive information. Here are expert tips to safeguard your credit card information while on the web

Bank card technology is changing, and changing fast with the promise to alter the way we conduct transactions and manage our finances. The traditional plastic card has undergone a remarkable transformation, blending cutting-edge advancements to enhance security, convenience, and adaptability.

As our lives become increasingly digitized, protecting our financial information and online accounts has become more crucial than ever. With the rise in cybercrime and the ever-present threat of fraudsters, it is essential to take proactive steps to safeguard our debit card details and secure our login credentials.

Access Bank Verve Card is a debit card issued by Access Bank in collaboration with Verve. It is a valuable addition to the world of electronic payment options, designed to make financial transactions smoother and more efficient for cardholders.

KCB Merchants are now empowered to enjoy Verve rewards as they accept payments from Verve cardholders at their merchant locations.

Verve Card has partnered with Google to make digital transactions on the Google Play Store easier and more accessible for Nigerians. As of today, Nigerians can use their Verve cards to make purchases on the Google Play Store, strengthening the digital ecosystem in Nigeria.

The fitness community in Nigeria and beyond has more to look forward to at Africa's Biggest Fitness Party this year as organizers of the VerveLife event prepare to take things a notch higher with the announcement of a Headline Partner- PUMA.

Verve, Africa’s leading domestic payment cards and tokens brand, and leading global sportswear giant, Adidas have announced a significant collaboration that takes the sixth (6th) edition of VerveLife, one of the biggest fitness festival series on the African continent, to the next level.

Africa’s leading payment card, Verve, celebrates milestones, as it expands its payment network to over 200 direct Scheme members across Africa, and issues over 35 million cards.

This year, VerveLife returns with its 6th edition centered around the powerful theme Breathe. ‘Breathe’ is a call to action for us to slow down, reconnect with our inner selves, let our ‘hair’ down, find solace in the present moment, and breathe. It's a reminder that no matter how hectic life gets, we have the power to pause, take a deep breath, and regain our balance.

Africa's leading payment cards and digital tokens brand, Verve, has launched its highly anticipated 4th edition of the Verve Good Life Promo tagged ‘The Verve Good Life Promo 4.0’ to reward its cardholders with exciting gifts and cash prizes.

As Nigeria’s First successful domestic payment card, Verve Card has proven to be more than just a payment option, it has become a staple in every Nigerian household and is being infused into their daily transactional lifestyle.

Verve, Africa’s leading payment technology and card business, has announced the launch of its third National Consumer Promo, aimed at rewarding its cardholders with exciting gifts and cash prizes that will enhance customer satisfaction and loyalty

CVV (Card Verification Value) is that tiny code on the back of your card and here's how it works.

In today's digital age, paying for things has gone beyond using physical cards to virtual cards. But the question is, which of these options suits your needs better? In this article, we'll discuss the pros and cons of both physical and virtual cards to help you make an informed decision.

Payments have come a long way in recent years, moving from the traditional use of cash to the convenience and efficiency of contactless transactions. As technology advances, payment methods have adjusted to meet consumers' changing needs and preferences. In this article, we’ll walk you through the payment evolution and introduce you to a modern way to make your payments smooth and secure.

Verve, Africa’s leading domestic payment cards and tokens brand, and leading global sportswear giant, Adidas have announced a significant collaboration that takes the sixth (6

Africa’s leading payment technology and card business, Verve International has welcomed its first francophone ecommerce and merchant aggregator, CinetPay into the Verve ecosystem

The Verve Accelerate program enables FinTech and non-banks to utilize the Verve platforms and network to accelerate the delivery of services and innovations into both new and existing markets.

The market is increasingly adopting contactless payments for their ease, convenience, and efficiency, providing users with a cashless option.

Payment innovation in Africa is rapidly growing, which is important for increasing financial inclusion across the continent.

In this article, we explain how Verve cards work and why they are the best choice for secure online shopping.

Here, we look at the difference between credit cards and debit cards to help you decide the right one for your needs.

Furthering our efforts to ensure the provision of seamless, innovative payment options, Verve, Africa’s leading payment cards and digital tokens brand, has collaborated with Sterling Bank, one of the leading innovative Nigerian banks, to launch Verve's first line of credit cards.

Verve, Africa’s leading payment cards, and digital tokens brand, has joined forces with Moniepoint Microfinance Bank, a fast-growing customer-oriented financial institution, to increase access to financial services for Nigerians through the launch of the Moniepoint Verve Debit Card.

Verve International, Africa’s 1st and largest domestic payments scheme has yet again announced a remarkable new milestone in its business, firmly consolidating its growing market share in Nigeria - in terms of card issuance and transactions.

Here's how to disable your ATM card and prevent unauthorized access to your bank account.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve eCash is a virtual card and wallet that lives inside the Quickteller app, which is perfect for secure online transactions without the need for a physical card. When you sign up, your virtual card details are stored securely in your wallet, and tokenization kicks in every time you make a purchase.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve eCash is a virtual card and wallet that lives inside the Quickteller app, which is perfect for secure online transactions without the need for a physical card. When you sign up, your virtual card details are stored securely in your wallet, and tokenization kicks in every time you make a purchase.

Shopping can be a thrilling experience, especially when discovering unique items on Temu. One common obstacle shoppers face is payment issues, particularly when using cards that may not be compatible. However, if you have a Verve card, you're in luck,because it's fully operational on Temu, allowing you enjoy a seamless shopping experience.

Africa’s 1st and largest domestic payments scheme and a subsidiary of The Interswitch Group, has been named in the first-ever Global Payments Power 50 list by The Power 50, recognising the most innovative companies driving innovation and transformation in the global payments industry.

Time is money, and nobody likes to waste it, especially when making payments. Long queues and slow processing can be frustrating. Verve, Africa’s renowned payment card, now offers a contactless card that addresses these concerns. By simply tapping your card, you can save more time per transaction, providing a streamlined solution for all your payment needs.

Have you ever wanted to master a new skill, switch careers, or finally take that course you've been considering? Now is your chance. With Verve Card now accepted on Udemy, learning has never been easier. Whether you're a professional looking to advance in your field, a student eager to expand your knowledge, or simply curious about exploring a new passion, you can access thousands of courses seamlessly.

Africa’s leading payment cards and digital tokens brand, Verve, has partnered with uLesson, an online learning platform to offer 10% discount off educational content and gadgets when payments are made with Verve cards on the uLesson website (ulesson.com).

Recently, we hosted a event for our ecosystem partners. The day was filled with games, networking, and sharing important milestones. It was both exciting and educational.

Verve is in a class of its own when it comes to making sure that cardholders live and enjoy the good life! Typical of Naija's "Agba" and "Odogwu" card to keep adding steez to its customers, it has added another goodie to its bouquet of good life. I guess you’re already wondering what this is about. Well, Verve has just added another feather to its already heavily decorated cap just for your uninterrupted pleasure.

Africa’s leading payment cards and digital tokens brand, Verve, has announced its partnership with the Lagos State Government on the relaunch of the Lagos State Residents Registration Agency (LASRRA) card.

As our lives become increasingly digitized, protecting our financial information and online accounts has become more crucial than ever. With the rise in cybercrime and the ever-present threat of fraudsters, it is essential to take proactive steps to safeguard our debit card details and secure our login credentials.

Verve, Africa’s leading domestic payment cards and tokens brand, and leading global sportswear giant, Adidas have announced a significant collaboration that takes the sixth (6th) edition of VerveLife, one of the biggest fitness festival series on the African continent, to the next level.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Recently, we hosted a event for our ecosystem partners. The day was filled with games, networking, and sharing important milestones. It was both exciting and educational.

Nigerians are known for their loyalty to brands that demonstrate resilience, make impactful contributions, and consistently offer solutions to their challenges. This is why millions of people in, and outside Nigeria are increasingly choosing Verve Card for its unmatched convenience and seamless transactions.

Africa's leading payment cards and digital tokens brand, Verve, has launched its highly anticipated 4th edition of the Verve Good Life Promo tagged ‘The Verve Good Life Promo 4.0’ to reward its cardholders with exciting gifts and cash prizes.

Verve, Africa’s leading payment technology and card business, has announced the launch of its third National Consumer Promo, aimed at rewarding its cardholders with exciting gifts and cash prizes that will enhance customer satisfaction and loyalty

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Africa’s 1st and largest domestic payments scheme and a subsidiary of The Interswitch Group, has been named in the first-ever Global Payments Power 50 list by The Power 50, recognising the most innovative companies driving innovation and transformation in the global payments industry.

Lagos, Nigeria – August 25, 2025 – VerveLife, one of the flagship lifestyle initiatives of Verve, Africa’s leading domestic payment card and tokens brand, is back for its 8th edition, themed “Elev8”. More than a fitness event, VerveLife has grown into a cultural movement that connects thousands of Africans through fitness, wellness, and community. This year, VerveLife is set to inspire participants to elevate their bodies, minds, and lifestyles like never before.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Africa’s 1st and largest domestic payments scheme and a subsidiary of The Interswitch Group, has been named in the first-ever Global Payments Power 50 list by The Power 50, recognising the most innovative companies driving innovation and transformation in the global payments industry.

“Water no get enemy.” This famous Nigerian proverb holds more truth than you might realize. As simple and literal as it sounds, water is indeed a lifesaver. Whether you’re powering through a fitness routine, attending a high-energy workout session, or just going about your day, staying hydrated is a must.

We all want to move through life with ease; from bending, lifting, and reaching without a second thought. But let’s face it, everyday movements like picking up groceries, getting out of bed, or even playing with the kids can become challenging if your body isn’t in shape. That's where the magic of exercise comes in.

Have you ever felt like you just wanted to pause, close your eyes, take a deep breath, and escape from the chaos of everyday life? We all do. The stress, noise, and constant demands can sometimes feel overwhelming. But what if you didn’t need a vacation to find peace? What if just a few minutes of moving your body could calm your mind and boost your mood?

Proper fueling your body before and after a workout is just as important as the exercises themselves. Whether lifting weights, running, or dancing, what you eat can make or break your performance. The right fuel gives you the energy to power through tough workouts and helps your muscles recover faster afterward.

Was your financial situation in shambles last year? Let’s face it, juggling subscriptions, online shopping, and everyday expenses without a plan can feel like a big task. Well, say goodbye to the old you, and let’s get you ready to meet the "new you" by making the most of your Verve card this year.

Imagine walking into your favourite store, picking up everything you need, and getting an instant discount just for being a loyal customer! Okay, hold that thought but stop stalling.

Nigerians are known for their loyalty to brands that demonstrate resilience, make impactful contributions, and consistently offer solutions to their challenges. This is why millions of people in, and outside Nigeria are increasingly choosing Verve Card for its unmatched convenience and seamless transactions.

Verve is in a class of its own when it comes to making sure that cardholders live and enjoy the good life! Typical of Naija's "Agba" and "Odogwu" card to keep adding steez to its customers, it has added another goodie to its bouquet of good life. I guess you’re already wondering what this is about. Well, Verve has just added another feather to its already heavily decorated cap just for your uninterrupted pleasure.

As Nigeria’s First successful domestic payment card, Verve Card has proven to be more than just a payment option, it has become a staple in every Nigerian household and is being infused into their daily transactional lifestyle.

Verve, Africa’s leading domestic payment cards and tokens brand, and leading global sportswear giant, Adidas have announced a significant collaboration that takes the sixth (6

Verve eCash is a virtual card and wallet that lives inside the Quickteller app, which is perfect for secure online transactions without the need for a physical card. When you sign up, your virtual card details are stored securely in your wallet, and tokenization kicks in every time you make a purchase.

The convenience of making purchases online comes with the responsibility of protecting one's sensitive information. Here are expert tips to safeguard your credit card information while on the web

In this article, we explain how Verve cards work and why they are the best choice for secure online shopping.

Here's how to disable your ATM card and prevent unauthorized access to your bank account.

Verve eCash is a virtual card and wallet that lives inside the Quickteller app, which is perfect for secure online transactions without the need for a physical card. When you sign up, your virtual card details are stored securely in your wallet, and tokenization kicks in every time you make a purchase.

The convenience of making purchases online comes with the responsibility of protecting one's sensitive information. Here are expert tips to safeguard your credit card information while on the web

In this article, we explain how Verve cards work and why they are the best choice for secure online shopping.

Here's how to disable your ATM card and prevent unauthorized access to your bank account.

CVV (Card Verification Value) is that tiny code on the back of your card and here's how it works.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

Verve, Africa’s leading domestic payments card is delighted to welcome Google Play as a strategic partner for the eighth (8.0) edition of VerveLife, which has progressively gained acclaim as Africa’s largest and most celebrated fitness event series. This partnership from a lifestyle activation perspective further consolidates

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

As Africa’s payments landscape rapidly evolves, contactless technology has become a vital enabler of speed, security, and convenience for consumers and merchants alike. Verve, Africa’s leading domestic payment card and digital token brand, is at the forefront of this transformation. With over 30 million contactless cards issued, Verve is accelerating the adoption of tap-and-go payments across Nigeria and other African markets, making everyday transactions faster and more secure, from supermarkets and fuel stations to airport terminals and restaurants.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

Shopping can be a thrilling experience, especially when discovering unique items on Temu. One common obstacle shoppers face is payment issues, particularly when using cards that may not be compatible. However, if you have a Verve card, you're in luck,because it's fully operational on Temu, allowing you enjoy a seamless shopping experience.

Africa’s 1st and largest domestic payments scheme and a subsidiary of The Interswitch Group, has been named in the first-ever Global Payments Power 50 list by The Power 50, recognising the most innovative companies driving innovation and transformation in the global payments industry.

Time is money, and nobody likes to waste it, especially when making payments. Long queues and slow processing can be frustrating. Verve, Africa’s renowned payment card, now offers a contactless card that addresses these concerns. By simply tapping your card, you can save more time per transaction, providing a streamlined solution for all your payment needs.

Have you ever wanted to master a new skill, switch careers, or finally take that course you've been considering? Now is your chance. With Verve Card now accepted on Udemy, learning has never been easier. Whether you're a professional looking to advance in your field, a student eager to expand your knowledge, or simply curious about exploring a new passion, you can access thousands of courses seamlessly.

We are pleased to announce that XHSmart has joined our network. XHSmart is a new personalization bureau that has been onboarded to support Verve issuers in Uganda. With their impressive background and technical skills, XHSmart brings a wealth of knowledge and expertise to our dynamic network. As Verve continues to grow and innovate in the financial technology sector, we believe that XHSmart's addition will undoubtedly contribute to our success, and we look forward to achieving new milestones together with delivering exceptional solutions to our clients. XHSmart is poised to contribute significantly to our ongoing and future initiatives, including our African expansion plans.

Recently, we hosted a event for our ecosystem partners. The day was filled with games, networking, and sharing important milestones. It was both exciting and educational.

The Verve Accelerate program enables FinTech and non-banks to utilize the Verve platforms and network to accelerate the delivery of services and innovations into both new and existing markets.

The market is increasingly adopting contactless payments for their ease, convenience, and efficiency, providing users with a cashless option.

Payment innovation in Africa is rapidly growing, which is important for increasing financial inclusion across the continent.

Verve is in a class of its own when it comes to making sure that cardholders live and enjoy the good life! Typical of Naija's "Agba" and "Odogwu" card to keep adding steez to its customers, it has added another goodie to its bouquet of good life. I guess you’re already wondering what this is about. Well, Verve has just added another feather to its already heavily decorated cap just for your uninterrupted pleasure.

Bank card technology is changing, and changing fast with the promise to alter the way we conduct transactions and manage our finances. The traditional plastic card has undergone a remarkable transformation, blending cutting-edge advancements to enhance security, convenience, and adaptability.

Verve Card has partnered with Google to make digital transactions on the Google Play Store easier and more accessible for Nigerians. As of today, Nigerians can use their Verve cards to make purchases on the Google Play Store, strengthening the digital ecosystem in Nigeria.

In today's digital age, paying for things has gone beyond using physical cards to virtual cards. But the question is, which of these options suits your needs better? In this article, we'll discuss the pros and cons of both physical and virtual cards to help you make an informed decision.

Payments have come a long way in recent years, moving from the traditional use of cash to the convenience and efficiency of contactless transactions. As technology advances, payment methods have adjusted to meet consumers' changing needs and preferences. In this article, we’ll walk you through the payment evolution and introduce you to a modern way to make your payments smooth and secure.

Verve, Africa’s leading domestic payment cards and tokens brand, and leading global sportswear giant, Adidas have announced a significant collaboration that takes the sixth (6

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

Shopping can be a thrilling experience, especially when discovering unique items on Temu. One common obstacle shoppers face is payment issues, particularly when using cards that may not be compatible. However, if you have a Verve card, you're in luck,because it's fully operational on Temu, allowing you enjoy a seamless shopping experience.

Time is money, and nobody likes to waste it, especially when making payments. Long queues and slow processing can be frustrating. Verve, Africa’s renowned payment card, now offers a contactless card that addresses these concerns. By simply tapping your card, you can save more time per transaction, providing a streamlined solution for all your payment needs.

For over 15 years, Verve has played a pivotal role in shaping Africa’s digital payment landscape, providing secure, convenient, and locally relevant payment solutions designed to meet the continent’s unique needs. Founded to address the limitations of international card schemes in African markets, Verve has grown into a trusted household brand with over 85 million cards issued and operations across several African countries. By tackling challenges like regulatory complexity and infrastructure limitations head-on, Verve has delivered robust, interoperable solutions that power millions of transactions daily across ATMs, POS terminals, and digital platforms.

In today’s interconnected world, strategic partnerships have become essential levers for growth, innovation, and customer satisfaction. Across Africa, digital adoption is accelerating, and cross-border commerce is gaining momentum. A new wave of collaboration is emerging, one that aligns domestic financial solutions with global platforms to deliver more value to everyday users.

Shopping can be a thrilling experience, especially when discovering unique items on Temu. One common obstacle shoppers face is payment issues, particularly when using cards that may not be compatible. However, if you have a Verve card, you're in luck,because it's fully operational on Temu, allowing you enjoy a seamless shopping experience.

Time is money, and nobody likes to waste it, especially when making payments. Long queues and slow processing can be frustrating. Verve, Africa’s renowned payment card, now offers a contactless card that addresses these concerns. By simply tapping your card, you can save more time per transaction, providing a streamlined solution for all your payment needs.

The market is increasingly adopting contactless payments for their ease, convenience, and efficiency, providing users with a cashless option.

Payment innovation in Africa is rapidly growing, which is important for increasing financial inclusion across the continent.

Furthering our efforts to ensure the provision of seamless, innovative payment options, Verve, Africa’s leading payment cards and digital tokens brand, has collaborated with Sterling Bank, one of the leading innovative Nigerian banks, to launch Verve's first line of credit cards.

Africa’s leading payment technology and card business, Verve International has welcomed its first francophone ecommerce and merchant aggregator, CinetPay into the Verve ecosystem

Verve, Africa’s leading payment cards, and digital tokens brand, has joined forces with Moniepoint Microfinance Bank, a fast-growing customer-oriented financial institution, to increase access to financial services for Nigerians through the launch of the Moniepoint Verve Debit Card.

This year, VerveLife returns with its 6th edition centered around the powerful theme Breathe. ‘Breathe’ is a call to action for us to slow down, reconnect with our inner selves, let our ‘hair’ down, find solace in the present moment, and breathe. It's a reminder that no matter how hectic life gets, we have the power to pause, take a deep breath, and regain our balance.

Here, we look at the difference between credit cards and debit cards to help you decide the right one for your needs.

Verve International, Africa’s 1st and largest domestic payments scheme, and an emerging reference-point in the burgeoning realm of domestic payment schemes globally, has again announced another remarkable new growth milestone, further consolidating its growing market share in Nigeria, in terms of payment card issuance and transactions.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve Card is a type of debit or prepaid card that allows you to make payments, withdraw cash, and shop online or in physical stores. Read more.

Access Bank Verve Card is a debit card issued by Access Bank in collaboration with Verve. It is a valuable addition to the world of electronic payment options, designed to make financial transactions smoother and more efficient for cardholders.

KCB Merchants are now empowered to enjoy Verve rewards as they accept payments from Verve cardholders at their merchant locations.

With over 85Million cards, and growing reach across Africa, Verve is turning everyday payments into moments of excitement.

Verve Card is a type of debit or prepaid card that allows you to make payments, withdraw cash, and shop online or in physical stores. Read more.

Access Bank Verve Card is a debit card issued by Access Bank in collaboration with Verve. It is a valuable addition to the world of electronic payment options, designed to make financial transactions smoother and more efficient for cardholders.

KCB Merchants are now empowered to enjoy Verve rewards as they accept payments from Verve cardholders at their merchant locations.

The fitness community in Nigeria and beyond has more to look forward to at Africa's Biggest Fitness Party this year as organizers of the VerveLife event prepare to take things a notch higher with the announcement of a Headline Partner- PUMA.

Africa’s leading payment card, Verve, celebrates milestones, as it expands its payment network to over 200 direct Scheme members across Africa, and issues over 35 million cards.

Verve International, Africa’s 1st and largest domestic payments scheme has yet again announced a remarkable new milestone in its business, firmly consolidating its growing market share in Nigeria - in terms of card issuance and transactions.